Reopening won't likely jumpstart the economy

Lockdowns got us into this recession. But now there's evidence that reopening won't get us out of it.

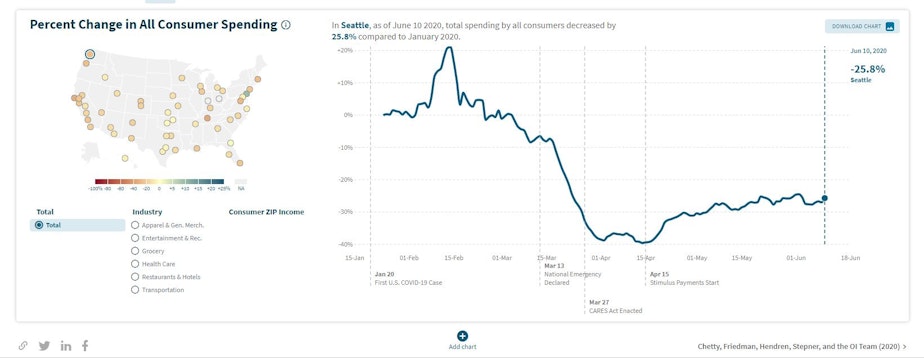

An analysis by Harvard and Brown universities shows that government efforts to stimulate the economy are failing. The rich, who have the most to spend, aren't doing it. The problem, the researchers say, is that this is a crisis caused by the coronavirus, and as long as the virus remains a threat, people will not return to their old patterns.

The analysis shows that in Washington state, middle class people have been spending their stimulus money. And people with low incomes, many of them buttressed by a $600 a week bump in unemployment assistance, are also spending. But the wealthy are staying in -- not traveling, not buying expensive toys, not holding lavish banquets.

They are exercising their right to lie low while coronavirus remains abroad, with no vaccine, no fast and reliable test, and no treatment that prevents serious illness.

“The virus is the boss," said Austan Goolsbee, former economic advisor to President Barack Obama, at a state senate meeting on pandemic recovery this week. "It decides what will be the response of people, because they’re afraid. They don’t want to catch the virus."

Goolsbee said ending this situation is not about ending lockdowns.

"This isn’t something that can be decided by mayors, by governors, by state senators, by the president," he said. "You can announce that all lockdowns are done; there are no shelter in place orders. Everyone can go back outside. But you should be circumspect about whether that will actually get people to go back to doing what they were doing before.”

In Seattle, the Harvard analysis shows, spending has declined 25.8 percent compared to January.

As this situation drags on, there's more risk of a widening circle of damage -- ripple effects.

“The ripple effects are things like, the small businesses that could not pay their rent now have put their landlords under financial pressure, and now the landlords can't make payments on their commercial mortgages," said Debra Glassman, an economist at the University of Washington.

"And therefore, banks are under pressure," Glassman said. "Banks surely will be less likely to make lots of loans to the next people who come in asking for bank loans.”

Staunching the flow of economic damage will be challenging.

In the next few months, the federal government faces two large questions: Whether and how to continue support for people without jobs by midsummer. The current plan is to stop the $600 weekly payment to jobless people by the end of July.

Another large decision: Whether the federal government will choose to support state and local governments, who are seeing their revenue shredded by the pandemic even as they are front and center in the battle to contain the disease.

Washington state this week announced furloughs for state workers in the face of an anticipated $8.8 billion drop in tax collections over the next three years.

Two big sets of decisions to watch for in the coming months.