Foreclosure Crisis? Seattle's Numbers Don't Add Up

A correction and further information on the story 9/14/2013:

We reported that Zillow was the source of two numbers included in the report “The Wall Street Wrecking Ball." The report stated that 33.5 percent, or a total of 42,000 mortgages in the city, are underwater. Zillow is the source of the 33.5 percent figure, however, the other number, 42,000, is not from Zillow but from Catalist, an organization which provides data to progressive organizations. The author of "The Wall Street Wrecking Ball," Saqib Bhatti, was aware that the Zillow numbers did not accurately describe the underwater problem in the city of Seattle. He was not referring to the numbers from Catalist.

Upon further examination, Catalist’s numbers also pose some problems. They include data from seven zip codes that are either not in Seattle or else only partially in the city. 42,000 underwater mortgages would mean that about 42 percent of the city's mortgage holders are underwater. That estimate differs wildly from both Zillow's and RealtyTrac's. It would mean Seattle's underwater mortgage problem is close to double the national average.

According to Zillow, Seattle has a much lower rate of underwater mortgages. It’s currently at 17.4 percent and has been declining since the beginning of 2012.

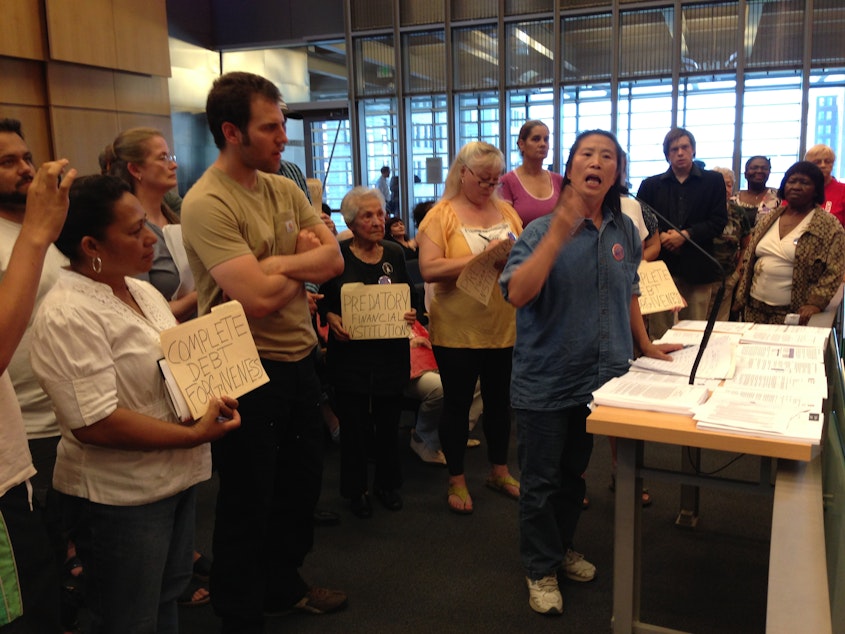

Housing activists descended on Seattle City Hall yesterday to try to get relief from home foreclosures.

Sponsored

In emotional testimony, they asked the city to use its authority to end what they called "a foreclosure crisis" in the city.

“With the numbers being as they are and our seniors losing their homes, our communities are being devastated,” said Rev. Lawrence Willis of TrueVine Missionary Baptist Church. “We have to do something.”

According to a report presented to the council by Cornell University Law Professor Robert Hockett, 42,000 homeowners in Seattle currently have mortgages that are underwater and are therefore at greater risk of foreclosure. “That is over one third — about 33.5 percent — of Seattle’s mortgage total, a remarkable statistic,” the report claimed.

Those numbers were used repeatedly during yesterday’s testimony to indicate the severity of the foreclosure crisis in the city.

But, as it turns out, one of those numbers is wrong, and the other appears highly inflated.

Sponsored

The source of the 33.5 percent number is Zillow, the Seattle-based real estate website, which publishes a quarterly underwater mortgage report. The number quoted doesn’t refer to Seattle, but rather to the Seattle metro area, which includes King, Pierce and Snohomish counties.

According to Zillow, there are fewer than 17,000 underwater mortgages in Seattle, less than half of what was claimed. Since the beginning of 2012, the numbers have steadily declined as home prices in the city have risen.

The same is true with the foreclosure rate. According to the company RealtyTrac, home foreclosures peaked in Seattle in October 2010 and have been declining ever since.

They are still higher than they were before the housing bust, and they still disproportionately affect poorer neighborhoods.

The other number, 42,000, is from an organization called Catalist, which provides data to non-profits. It was included in a report entitled “The Wall Street Wrecking Ball” which was authored by the Washington Community Action Network, a housing advocacy group. The misquoted 33.5 percent number from Zillow appears in that report as well. Cornell University's Professor Hockett cited “The Wall Street Wrecking Ball” as his source for both figures.

Sponsored

Saqib Bhatti, the author of the report, said he knew 33.5 percent number did not describe the underwater mortgage problem in the city of Seattle, but "that was the best publicly available data we had at the time."

In March of this year, the City Council adopted a resolution pledging the city would do more to stem foreclosures. The resolution similarly misquotes Zillow data from mid-2012, claiming that 38 percent of city homeowners were underwater on their mortgages.

City Council member and Housing Committee Chair Nick Licata has been pushing for the city to act to help distressed homeowners. When told that council's data overstates the problem, he wasn't concerned. “What we do know is that a certain amount of homeowners are being affected negatively and are in the position of possibly losing their homes,” he said. “So that is what we want to focus on.”

The City Council is looking at several options to help stem foreclosures, including using its powers of eminent domain to take over troubled mortgages. Richmond, California, is the only US city attempting that and it’s currently being sued by two banks in US District Court.