What other banks are loaning money to the Dakota Access Pipeline?

The City of Seattle promised last month that it would stop banking with Wells Fargo, because the bank pledged hundreds of millions in loan money to build the Dakota Access Pipeline.

After we aired that report, several of you called asking what other banks are involved in paying for the pipeline.

The list of banks below includes the minimum amount they have loaned. We looked through Securities and Exchange filings, and those don’t always include the full amounts.

If you have official information that is not included here, please email iraftery@kuow.org.

We have included banks that loaned money in the last two years to the companies in charge of the pipeline — Energy Transfer and Sunoco Logistics Partners, which will merge this year. Although these banks did not directly loan money for the pipeline project, they are showing support of the companies that own the pipeline.

Sponsored

Please note that banks aren’t the only businesses that invest in energy projects. We've only listed financial institutions with ties to the pipeline and its parent companies.

Also, these are the banks we found with some stake in the Dakota Access Pipeline. There are many more energy projects out there, as you know, like the Keystone XL Pipeline and the Eastern Gulf Crude Access Pipeline.

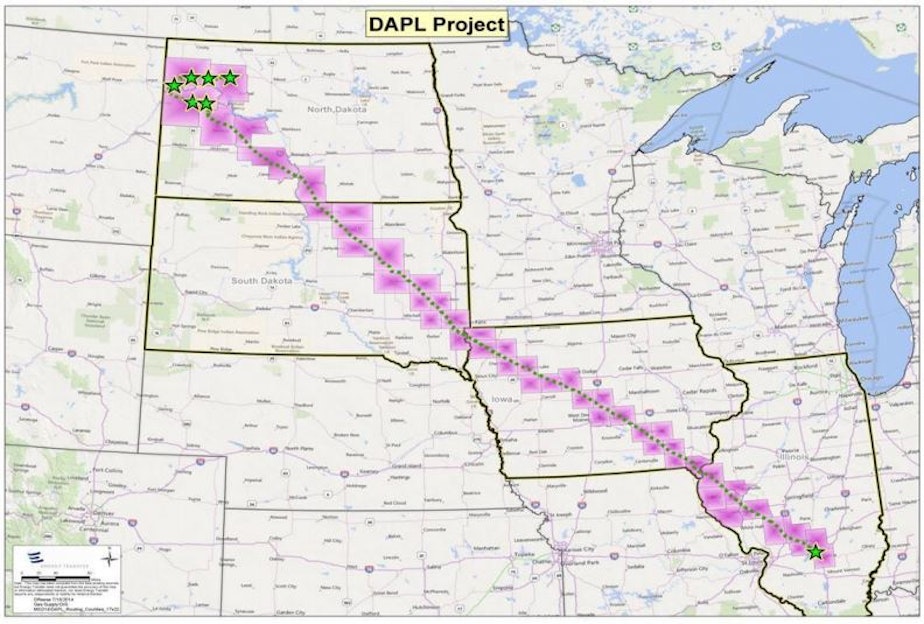

The Dakota Access Pipeline kicked up mass protests at the Standing Rock Sioux Reservation, with thousands of people descending on the area despite the bitter cold.

Banks have responded to the controversy in different ways. For example, ING said it could not withdraw the loan agreement because “We have signed a contract, which is legally impossible to withdraw from.”

ING said it had met with leaders from the Standing Rock Sioux tribe last month.

Sponsored

Some banks that have given loans to Sunoco and Energy Transfer have denied the connection to the Dakota Access Pipeline.

PNC does not provide, and never has provided, project financing for the Dakota Access Pipeline. We understand that there is a specific, bank-provided project financing facility for the Dakota Access Pipeline, and we are not and have not been a participant in that financing.

But Securities and Exchange filings show that PNC put $100 million toward a revolving credit of $3.7 billion to Energy Transfer Partners in 2015.

TD Securities (USA)

Sponsored

Headquarters: Toronto, Canada

$130,000,000

Intesa Sanpaolo, New York Branch

Headquarters: Turin, Italy

$159,000,000

Sponsored

Community Trust Bank

Headquarters: Pikeville, Kentucky

$30,000,000

ING

Headquarters: New York City

Sponsored

$75,000,000

Citibank (lending agent; they wrangled the money from the other banks)

Headquarters: New York City

$221,250,000

Barclays Bank

Headquarters: London, U.K.

$305,000,000

Bank of Tokyo-Mitsubishi UFJ

Headquarters: Tokyo, Japan

$247,500,000

Mizuho Bank

Headquarters: Tokyo, Japan

$448,000,000

PNC Bank

Headquarters: Pittsburgh, Pennsylvania

$230,000,000

Wells Fargo Bank

Headquarters: San Francisco

$315,000,000

Bank of America

Headquarters: Charlotte, North Carolina

$315,000,000

Bank of Nova Scotia

Headquarters: Toronto, Canada

$100,000,000

BNP Paribas

Headquarters: Paris, France

$100,000,000

Compass Bank

Headquarters: Birmingham, Alabama

$275,000,000

Credit Suisse (including Cayman Islands branch)

Headquarters: Zurich, Switzerland

$275,000,000

DNB Capital

Oslo, Norway

$275,000,000

JPMorgan Chase Bank

Headquarters: New York City

$275,000,000

Royal Bank of Canada

Headquarters: Montreal, Canada

$275,000,000

Sumitomo Mitsui Bank

Headquarters: Tokyo, Japan

$200,000,000

SunTrust Bank

Headquarters: Atlanta, Georgia

$275,000,000

UBS, Stamford Branch

Headquarters: Basel, Switzerland

$275,000,000

US Bank

Headquarters: Minneapolis, Minnesota

$275,000,000

Citizens Bank

Headquarters: Providence, Rhode Island

$72,500,000.00

Comerica Bank

Headquarters: Dallas, Texas

$72,500,000

Goldman Sachs Bank

Headquarters: New York City

$72,500,000

Morgan Stanley / Morgan Stanley Senior Funding

Headquarters: New York City

$163,750,000

Deutsche Bank

Headquarters: Frankfurt, Germany

$210,000,000

Royal Bank of Scotland

Headquarters: Edinburgh, Scotland (U.K.)

$185,000,000

HSBC

Headquarters: London, U.K.

$159,000,000

Credit Agricole

Headquarters: Montrouge, France

$159,000,000

These banks have been noted by other agencies and journalists, but we couldn’t confirm directly with the pipeline or the Securities and Exchange Commission:

ABN Amro Capital

Natixis

BayernLB

ICBC London

Societe Generale