No Citizenship? No Problem For IRS

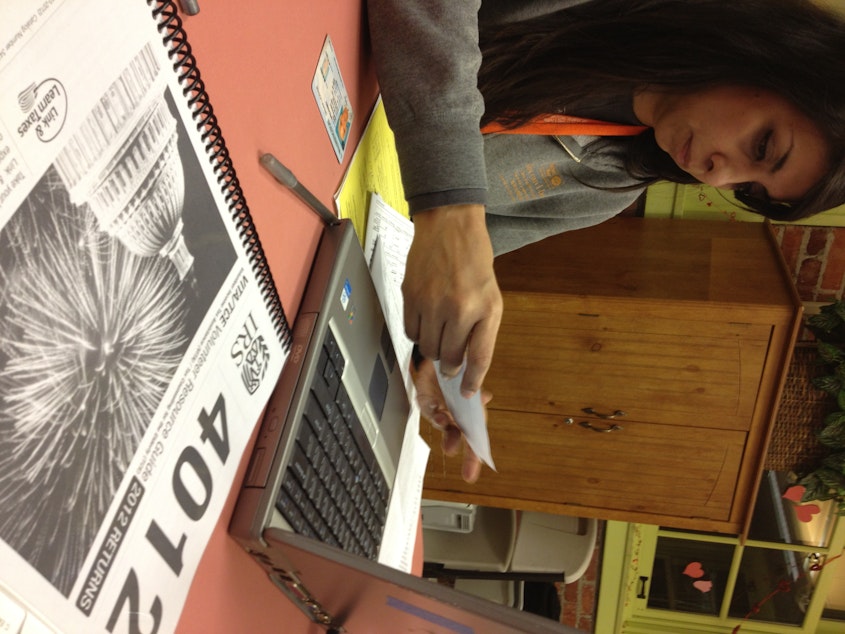

On a recent night at El Centro de la Raza, in Seattle’s Beacon Hill neighborhood, undocumented workers show up with folders of paperwork. They’ve come to this Latino-focused non-profit to get help with their tax returns.

People have brought W-2s from their employers, previous tax returns and a photo ID. Yet, the one essential document they lack – the one requested right at the top of the IRS form – is a valid social security number.

You may wonder how people who are working in the county illegally are able to file a tax return. Well, leave it to the IRS to find a way to collect.

In these cases, the government can issue someone an Individual Tax Identification Number. According to federal data, nearly 3 million people filed taxes with an ITIN in 2011.

At El Centro de la Raza, the first step for many tax filers is to fill out an ITIN application.

Sponsored

Considerations for Undocumented Taxpayers

El Centro is one many locations where the United Way of King County operates a free tax service for low-income people. Yuri Kim manages United Way’s Basic Needs Programs, which include the tax service. “About a third of clients we see at El Centro de la Raza specifically come in with ITINs and are undocumented,” Kim said.

Kim says all the bilingual tax prep volunteers are trained to handle issues unique to undocumented immigrants. The main issues are that people who file with an ITIN are not eligible for certain tax credits. "The earned income tax credit is a really big boost for someone who is lower-income and working, but someone with an ITIN is not able to get that. That credit can add up to a few thousand dollars," Kim said.

Volunteers are also trained to answer a common question from ITIN filers: “Will it flag the federal government that someone is undocumented? The IRS clearly states this information is not shared with immigration authorities.

Taxes and Immigration Reform

Sponsored

In the waiting area outside El Centro’s tax service, a man named Rogelio is bouncing his one-year-old grandson in his arms. Rogelio’s already finished his return and now his teenage son is inside filing one of his own.

Rogelio asked to only use his first name because his family is in the US illegally. They came here eight years ago from Sinaloa, Mexico.

Rogelio works as a painter and says he’s always paid his taxes here, even when employers pay him cash under the table. “It’s an obligation to have everything in order,” Rogelio said. “If we have all our taxes paid, it’ll help us out with the reform.”

Like others here, Rogelio is hopeful Congress will pass an immigration reform bill this year and that it will include a way for them to become citizens. If that happens, there’s a good chance the citizenship process would require people to settle up on any unpaid back taxes.

That idea sounds fine to Rogelio and to another man here named Gil. “I agree,” Gil said. “If they’re going to do the reform then I think everyone should be required be current with all of our taxes and following the law.”

Sponsored

Gil also asked to just use his first name because of his legal status. He says he files his tax return every year, just like pretty much everyone else he knows who’s undocumented.

Doing the Math

“We know that a substantial share of undocumented tax payers are paying into the system the same way the rest of us are,” said Matt Gardner, Executive Director of the Institute on Taxation and Economic Policy, a non-profit based in Washington DC. Gardner published a report in 2011 that estimates how much undocumented immigrants pay in local, state and federal taxes.

Gardner conservatively estimates that at least half of unauthorized immigrants pay federal income taxes. On the state and local level, Gardner says, “the vast majority are taxes that are blind to whether you’re a citizen or not. Sales taxes, excise taxes - the taxes that are the engine of Washington state and local government are taxes that everyone pays, including undocumented immigrants.”

Gardner’s findings are drawn from tax records, census data and other government estimates. The social security administration, for example, estimates about 75 percent of undocumented workers pay into the system - toward a retirement benefit they can’t collect.

Sponsored

While many undocumented immigrants say they file a return simply because it’s the law, there are other reasons. Some need the paperwork for a home loan. Others need it when their US-born children head to college and apply for federal financial aid. A tax return is part of the application.

Steven Camarota is Director of Research with the Center for Immigration Studies, which calls for lower levels of immigration. Camarota sees another big reason for these ITIN returns. “Well in general, when illegal immigrants file tax returns it’s so that they get all their money back,” Camarota said.

Camarota points to a US Treasury Inspector General’s report, which includes some of the most recent data about ITIN tax returns. The 2011 report found that people who file ITIN returns tend to get money back. In 2011, these refunds added up to nearly seven billion dollars.

Related to immigration reform, Camarota is skeptical about proposals that people would pay back taxes. He thinks politicians just talk up the idea because it polls well, but he calls the plan a dead end.

“There’s often not a good record of the illegal immigrant's work,” Camorota said. “As well as the fact that illegal immigrants are generally poor, with a large number of dependents, so they don’t owe any taxes anyway. So the idea they’d pay back taxes is mostly just a public relations thing you’d put in a bill to garner additional support. It wouldn’t generate any actual money.”

Sponsored

As the tax night wrapped up at El Centro de la Raza, a Mexican man named Jose Lopez signed off on his return. He says he worked at 10 different farms in eastern Washington last year, doing everything from minor construction to animal care. His refund is $208.

“No big deal,” Lozez said. “It’s better than having to owe.”