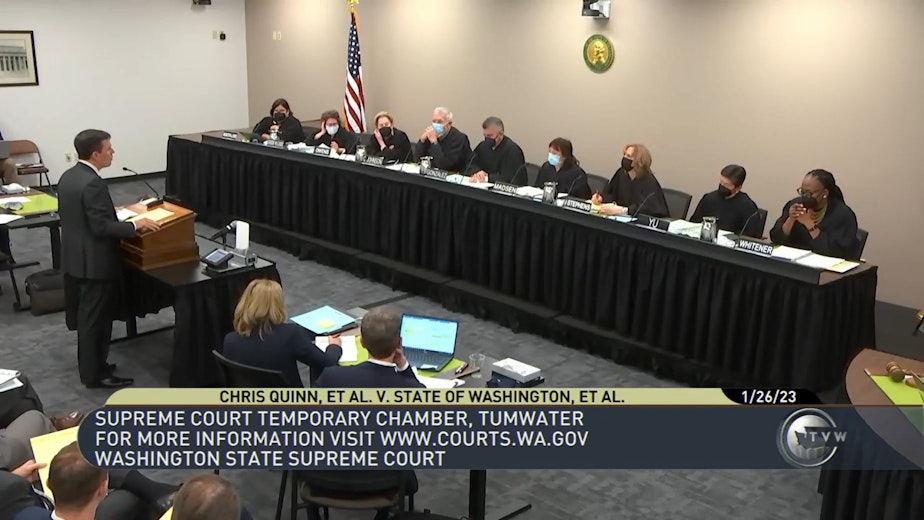

Capital gains tax challenge reaches Washington Supreme Court

The debate over whether wealthy people in Washington should pay a capital gains tax has reached the state Supreme Court, which heard oral arguments in Quinn v. Washington on Thursday.

Supporters say it’s an issue of tax fairness. Opponents say this is yet another unconstitutional attempt to pass an income tax. This was the determination of the lower court, which ruled against the tax last March.

Supporters of the state’s capital gains tax say the lack of an income tax in Washington has created a structure where poorer people pay a much greater share of their income in taxes than wealthier people.

In 2021 lawmakers passed a 7% tax on profits from sales of assets like stocks and bonds over $250,000. They called it an excise tax on those transactions.

Anti-tax groups sued, calling it an income tax. Former Attorney General Rob McKenna argued the case on behalf of the plaintiffs Thursday, and said the excise tax label is incorrect.

“There’s nothing new under the sun when it come to this issue, in the sense that trying to call an income tax an excise, trying to tax income by imposing an excise on the privilege of receiving income has been tried several times in this state by state Legislature and it’s been struck down every time,” McKenna said.

The state constitution says property taxes must be uniform, so the property of wealthier people can’t be taxed at higher rates. The Washington Supreme Court ruled in 1933 in the case Culliton v. Chase that income is property and therefore any income taxes are subject to the same constitutional restrictions.

Sponsored

The Washington Supreme Court could agree with the Douglas County Superior Court and find the tax unconstitutional. Even if the court determines that the capital gains tax is an excise tax, justices had a lot of questions about whether the state could legally tax transactions that occur in New York and elsewhere outside Washington when people sell off assets.

UW constitutional law professor Hugh Spitzer, who spoke at a press briefing on behalf of backers of the tax last week, said a second path would be for the court to determine that the capital gains tax is not an income tax, but instead a legitimate excise tax. That would be a relatively narrow decision that would allow the tax to survive.

But it wouldn’t touch the consequential issues around whether the state constitution prohibits a progressive income tax. A third pathway would be for the court to revisit the Culliton case from 1933 which struck down a voter-approved graduated income tax.

Justice Debra Stephens asked attorney Paul Lawrence, who argued in support of the capital gains tax, “Can you address how we look at a bench of nine second-guessing a former bench of nine on arguments that were raised and dismissed in prior cases?”

Lawrence responded, “I think the second part of your question is the problem here. The arguments we are raising and the arguments on why Culliton is wrong have never been thoroughly discussed by this court.”

Sponsored

Lawyers for the state urged the justices to issue their decision as soon as possible, to give guidance to taxpayers and lawmakers alike.

“The tax is due on April 18," Solicitor General Noah Purcell said. "And the legislative session is proceeding right now with budget writers factoring in whether this revenue will be available and so on.”

It’s expected to raise about $500 million per year. That funding is aimed at early learning, education, and school construction.