Are Washington’s wealthiest waiting out the state’s capital gains tax?

Washington's capital gains tax is a relatively new tax, and it's usually only paid by a small group of wealthy Washingtonians — people selling high-value stocks, bonds and mutual funds worth more than $250,000.

RELATED: Capital gains tax receipts in Washington state tumble

This year, tax revenues are expected to drop almost half a billion dollars, largely because it looks like that tax is going to bring in a lot less than last year.

That's not cause for alarm in a state with over $2 billion in reserves, but the state’s chief economist, Dave Reich, has a few theories on why the forecasts have been dropping this year.

"I have no idea what it's like to be a large capital gains earner, but if I was, I would be thinking, 'Hmm, maybe I should. Should I wait?'" Reich said.

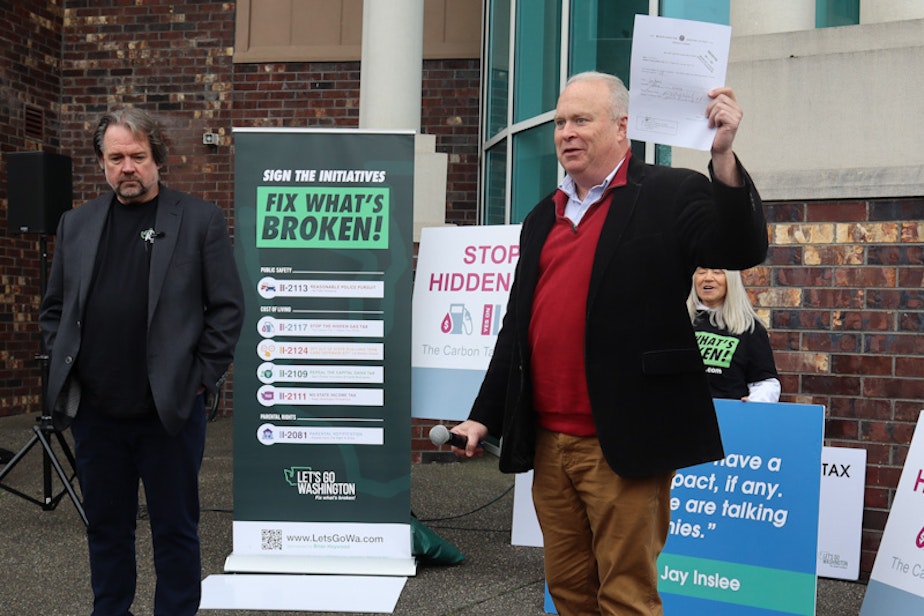

That is, wait until November, when Washington voters will choose whether to repeal the capital gains tax. It's the subject of a Republican-backed initiative largely funded by a Redmond hedge fund manager, Brian Heywood.

Sponsored

"I would do the math," Reich said of investors subject to the 7% capital gains tax. "Does it make sense for me to pay 7% now and realize it, or to wait till November and maybe not have to pay that 7%?"

Ryan Alderfer is a certified financial planner in Bellevue who often works with clients subject to the tax. He said he would advise a client not to sell right now.

"My personal philosophy is that you shouldn't invest based on your politics. Now, that being said, there's a little saying that investments are a matter of opinion and taxes are a matter of fact," Alderfer said.

RELATED: Campaign kicks off to save Washington's capital gains tax

Alderfer points to last year, when the tax brought in almost $800 million — he says, because investors thought the tax would get thrown out by the courts, during a legal challenge that hit a dead end in January.

"I think there were a lot of people who were looking at the legal challenges to it," Alderfer said, "thinking they might not have needed to pay the income tax. And then when it was found constitutional, whether you agree with that decision or not, I think that resulted in probably a larger overall receipt of funds than maybe was anticipated."

Sponsored

Alderfer says if the tax stays, some of his clients might move out of state, not unlike Jeff Bezos, who moved to Florida last year and is now unloading billions in Amazon shares. Florida has no capital gains, income, or estate tax. Personally, Alderfer said he plans to vote to repeal the tax.

RELATED: Seattle is minting millionaires by the thousands

Proponents of the tax argue Washington's system, which also has no income tax, forces the poorest residents to pay a bigger percentage of their income than the richest.