Inslee offers support for temporary delay in new payroll tax for long-term care program

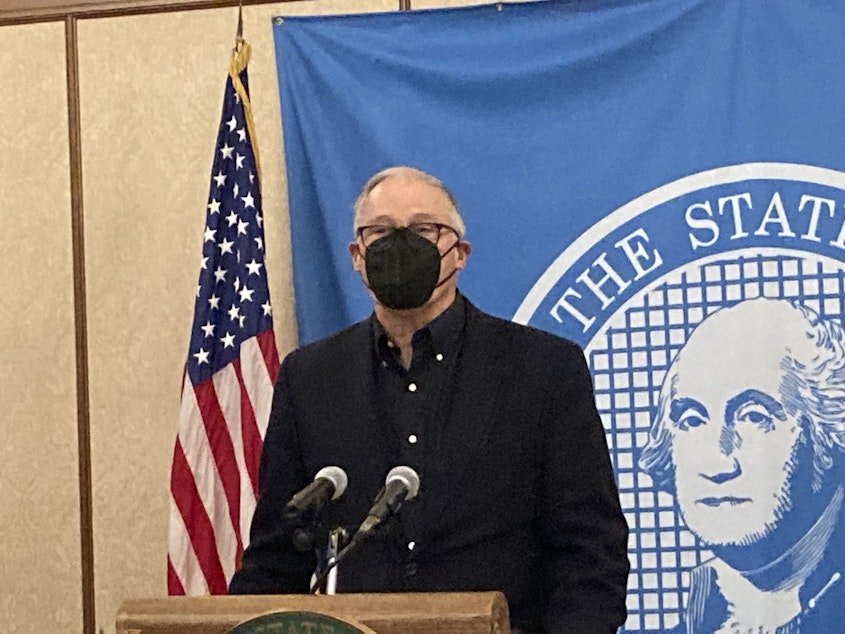

Washington Gov. Jay Inslee said Thursday that he would support a delay in the implementation of a new payroll tax to fund a first-in-the-nation long-term care benefit program called WA Cares.

“If the Legislature has a meaningful way to do that, I think it makes sense,” Inslee said during a news conference at the Capitol.

On Wednesday, Democratic leaders in the state Senate sent Inslee a letter urging him to delay implementation of the WA Cares program for one year.

“This delay will allow the legislature time during the 2022 legislative session to engage the public in a transparent, deliberative process to address concerns that have been raised with the WA Cares Fund without being limited by a premium assessment that is already in progress,” the legislators wrote.

The letter writers also said that while they continue to support the WA Cares program “now is not the time to add a payroll deduction” because of the ongoing pandemic.

Sponsored

“We know Washingtonians face challenges with housing, childcare and other costs during this recovery and we do not want to add another at this difficult time,” the letter said.

But Inslee said Thursday he doesn’t have the authority to halt the program using his COVID-19 emergency powers. Instead, he said, lawyers were looking at whether the collection of the payroll tax, which is scheduled to begin in January, could be delayed until April.

“I am sensitive and empathetic to the need for some changes in this bill,” Inslee said.

Inslee did not rule out the possibility of a special session of the Legislature before January to halt implementation of the tax.

House Majority Leader Pat Sullivan, also a Democrat, said Thursday it would be "extremely difficult" to pull together a special session before the end of the year. Still, he expressed openness to a delay in the implementation of the tax to address concerns with the program.

Sponsored

Among the issues that have been raised is that border-crossers who work in Washington, but live in Oregon or Idaho, will pay the tax but not be able to collect the benefit because it's not portable. Another source of criticism is that some people nearing retirement will have pay into the program, but won't qualify for the benefit because it takes several years to vest.

“A delay would give us more time to address those issues and other concerns that have been raised by constituents," Sullivan said.

However, a coalition advocating for the WA Cares Fund was quick to criticize talk of any delay.

"Delaying WA Cares would harm an estimated 38,000 disabled, elderly, or seriously ill people who are desperate for long-term care benefits in 2025," said Jessica Gomez with Washingtonians for a Responsible Future in a statement.

Under WA Cares, workers will pay a $0.58 tax on every hundred dollars of earnings. Beginning in 2025, workers who qualify could access long-term care services with a lifetime maximum benefit of $36,500.

Sponsored

This story has been updated.

Copyright 2021 Northwest News Network