A $40,000 salary is no longer middle class in Washington state. Here's why

New numbers show that Seattle’s middle class is slipping, and it’s not because people are making less money. It’s because their money doesn’t go as far in rent, taxes and the cost of living.

Look what's happened to an income of $40,000. In 2015, the Institute on Taxation and Economic Policy (ITEP), based in Washington, D.C., looked at incomes in Washington state and found that a salary of $40,000 was still middle class. It was smack-dab in the middle of middle-earning incomes in the state.

In 2018, ITEP looked again. This time, $40,000 had slipped a notch, to the second-lowest 20 percent of earners. The reason: More people in the state were making higher-end incomes.

Slipping an income category isn’t just about a loss of class status. ITEP says Washington state’s tax system gives lower earners unequal treatment.

The state has no income tax and relies heavily on sales and property taxes. In Seattle, everyone pays 10.1 percent sales tax on purchases excluding food, regardless of their income. For people making less, that creates a tax burden that is disproportionately larger.

The Washington, D.C.-based institute says this is what lands Washington state at the top of its "Terrible Ten” list of states whose tax systems make life tougher for people who make less money.

Sponsored

The top 1 percent in Washington make more than $545,000. For them, state and local taxes cost just 3 percent of their income.

People who make around $40,000, however, pay 12.5 percent of their incomes to state and local taxes.

This puts pressure on people making $40,000 and living in suddenly-expensive Seattle.

“You definitely notice it, being in Seattle,” said Lamont Hendrix, a banker and musician living in West Seattle. “The increase in the money that it takes to be able to live.”

He says he’s noticed that taxes are hitting him harder. With his new apartment farther from work, he notices gas taxes.

Sponsored

To understand the role that state and local policies play in reducing or exacerbating the gap between rich and poor, The Ravitch Fiscal Reporting Program at the Newmark School of Journalism helped start reporting projects in New York, Seattle, Atlanta and cities in Texas. All are booming economic centers that rank in the top 10 on any list of inequality in America.

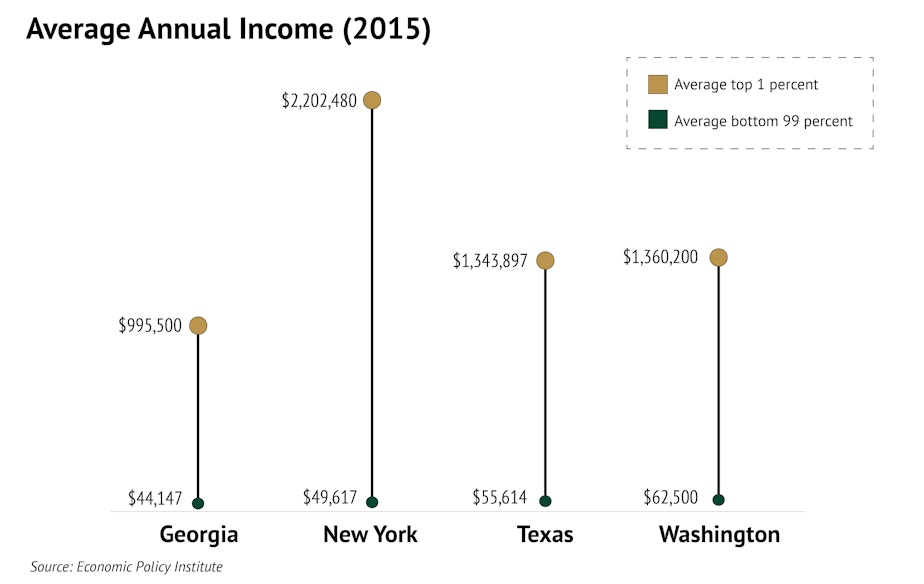

The charts show how Seattle compares with the other states.

The gap between rich and poor is most extreme in New York, by far. Over the decades, NYC has stepped in to try to keep the city livable for people of ordinary means. Rent control is a cornerstone. So is housing assistance: A family of four making $104,000 qualifies.

By contrast, rent control is illegal in Washington state. A family of four making $45,000 in Seattle qualifies for rental assistance for a maximum of six months.

Sponsored

Despite New York's policies, housing is still in crisis. The New York Housing Authority is scandal-ridden. There are 61,000 homeless people in the city. King County, which includes Seattle, had 12,000 at the latest count.

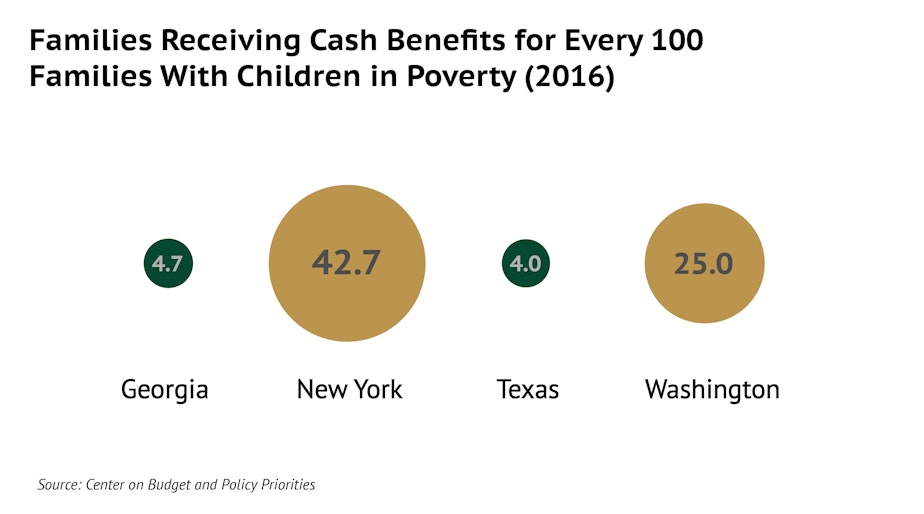

Another place where New York shines is in cash benefits to poor families with children. Washington provides a quarter of families in poverty with cash benefits, which is better than many states — but not better than New York.

Both Washington and New York, locally and at the state level, have policies that attempt to soften the gap between rich and poor and keep a certain standard of living in high-cost areas.

But Washington state has the distinction of having its own tax system exacerbate that gap.

Sponsored

This story was produced in partnership with the Ravitch Fiscal Reporting Program at the Newmark Graduate School of Journalism at the City University of New York.