What Biden's student debt relief means for Washington state borrowers

President Biden announced plans this week to cancel $10,000 in student debt for millions of Americans, and up to $20,000 for Pell Grant recipients.

What does this mean for borrowers in Washington state, and how do you know whether you qualify?

Although Washington ranks toward the bottom of states when it comes to the amount of student loan debt (48th in the nation according to WalletHub), plenty of Washingtonians have borrowed money from the federal government to help pay for their education.

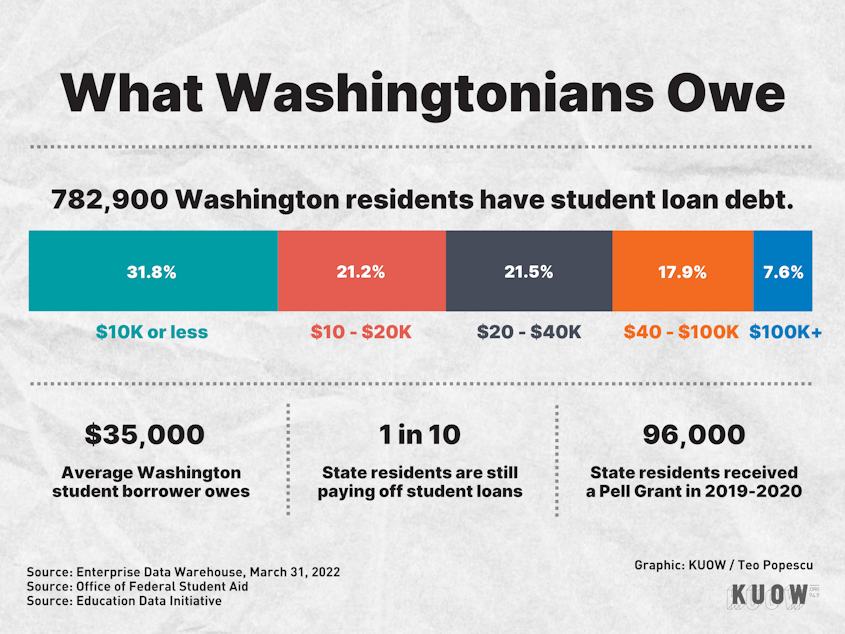

According to the most recent Federal Student Aid report, almost 783,000 Washington residents have a total of more than $28 billion in student aid.

One of those borrowers is Megan Fishbaugh, a clinical social worker at a Seattle hospital. Fishbaugh, who moved to Washington state in 2016 to pursue her master's in social work at UW, said she graduated with six figures in student loan debt.

"As a social worker, my annual salary is less than my total amount of debt, so it's pretty challenging to think about paying that off," she said.

Sponsored

Statistics from the Enterprise Data Warehouse show that Fishbaugh is not alone. More than 41,000 Washington residents owe between $100,000 and $200,000 in student loans. Meanwhile, 18,000 residents owe more than $200,000.

Fishbaugh said she is glad the issue of student debt was being discussed and grateful Biden's plan was offering some relief. But she hopes this is just the first step.

"For me, having that six figures of loan debt, it's kind of a drop in the water," she said.

To qualify for Biden's plan, borrowers have to earn $125,000 or less or have a household income of $250,000 or less. Current students are eligible if their loans originated before July 1, 2022.

In addition to the debt forgiveness, Biden's plan calls for a final extention of the pandemic pause in student loan payments until the end of 2022. The plan also puts a cap on the monthly payment of undergraduate loans at 5% of a borrower's discretionary income. And it increases the amount of income considered non-discretionary from 150% to 225% of the poverty level.

Sponsored

To figure out your discretionary income, use the Discretionary Income Calculator or call 844-669-4407.

To find out more about student aid and resources to deal with student debt, visit the Washington Student Achievement Council website or call 360-753-7800.

Graphics by Teo Popescu.